Every retailer is curious about what they sell or how much money they make in a given time. However, inventory management can be a hassle that negatively impacts numbers. That's why retailers need to have another metric in their hands to understand predictive sales and how much inventory they need.

To do the math, it's crucial to understand what inventory turnover ratio is. It will help you analyze what you can sell, plan your purchasing amount and frequency while giving you a better analysis of how efficient your sales are. It's a simple but essential metric that needs to be monitored according to your business needs.

Let's get to the basic definition of inventory turnover and then dive deeply into the tactics and methods to optimize the ratio!

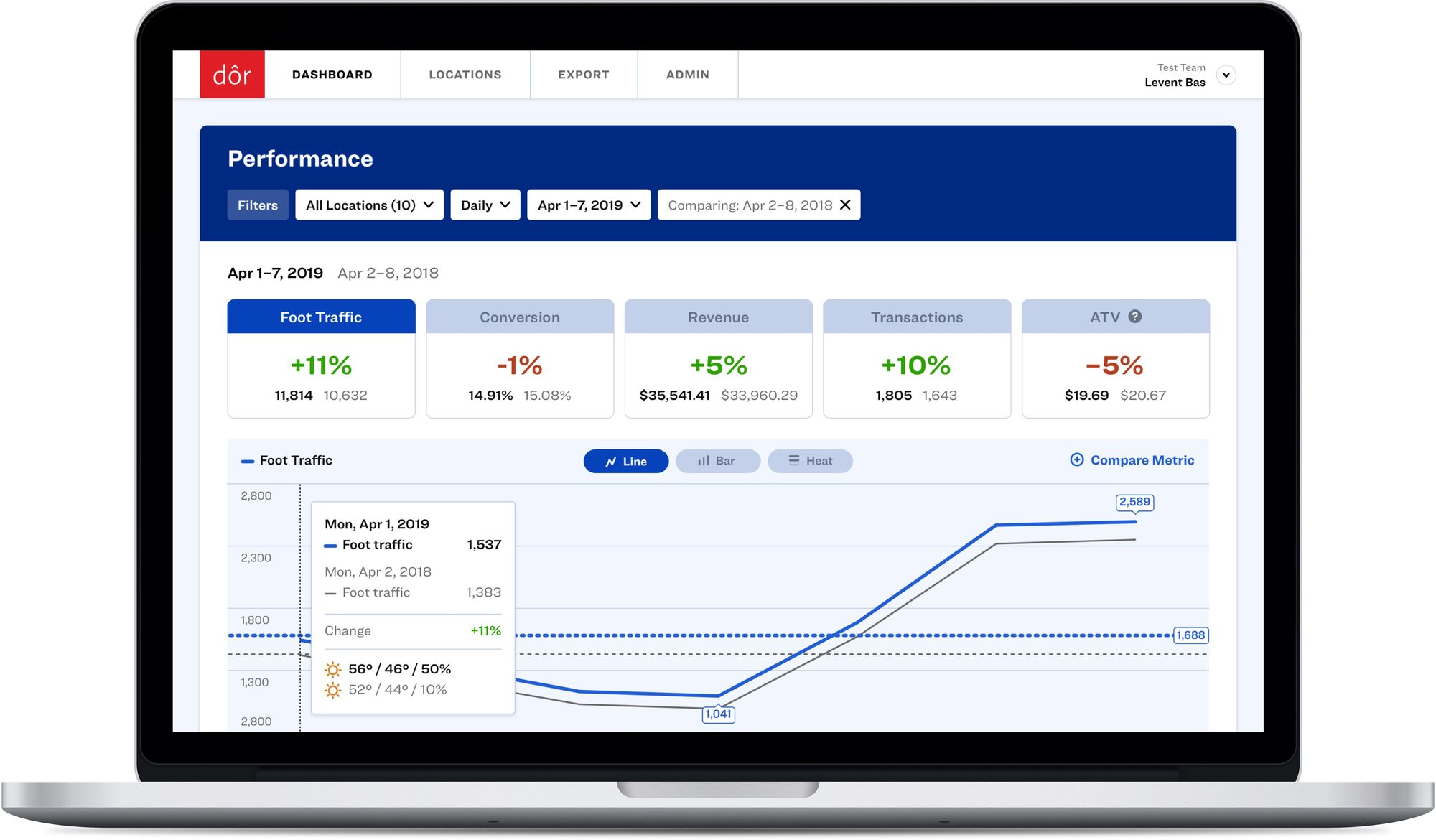

Did you know that a 1% increase in your store’s conversion rate can mean a 10% increase in revenue?

Click here to discover how Dor can help you understand your foot traffic data and make more profitable business decisions.

Ready to purchase? Complete your purchase in just minutes!

What is inventory turnover ratio?

The inventory turnover, or sometimes referred to as “inventory turns,” “stock turn,” or “stock turnover,” is basically how many times a product is sold and replaced in a given time.

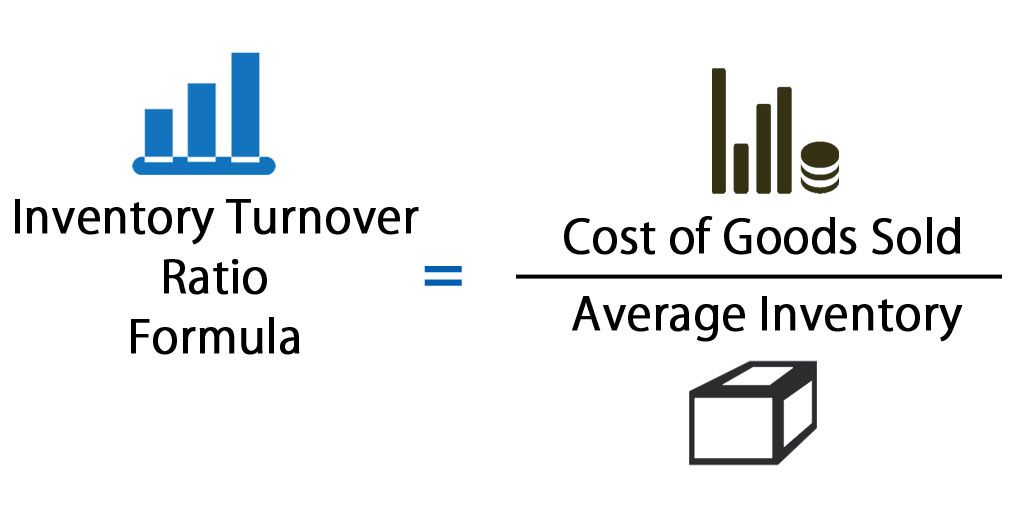

Inventory Turnover Ratio = Cost of Goods Solds / Average Inventory

This ratio is used to determine how your business performs overall and how efficient your inventory management works. The ratio is calculated with a few determinants, and generally, the higher the ratio is, the better the business performs.

However, it's safe to say the final number is varied from industry to industry.

Related: 15 Key Metrics (KPIs) to Measure Retail Store Performance

Why is inventory turnover so important for retail?

By assessing your inventory turnover within a given period -monthly, quarterly, bi-annually, or annually- you may determine your pain points, work on alternative methods to clear the aisle, offer better deals for your customers, and win in the end-game.

However, to achieve these all, you need to know the inventory management metrics and how to calculate them.

What are inventory management metrics?

There are some other metrics to use to analyze how well you orchestrate the inventory management tactics. These calculations help the businesses to analyze their stock in some alternative ways so you can deepen your predictions.

Here are some of the most important inventory management metrics other than the inventory turnover ratio.

- Cost of goods sold a.k.a COGS is one of the most important KPIs that you should keep track of. Many retail analytics formulas depend on this value and this is one of the core values to determine whether your business is profitable.

Cost of goods sold = (Cost of beginning inventory – Previous inventory) – Cost of ending inventory

- Average inventory is also the main determinant of the inventory turnover ratio and this value also used in some of the calculations you’ll see below. No matter how simple it looks, calculating the average inventory periodically is going to change the way you run your retail business.

Average inventory = (Beginning inventory - Ending inventory) / 2

- As you can see ending inventory is used to determine average inventory. This value may have a little twist in the calculation as you need carefully include your year around purchases.

Ending inventory = beginning inventory + purchases - COGS

- Stock to sale ratio is the available stock to stocks sold. This metric is an important figure because, in order to avoid excess inventory, you have to make sure that your average inventory level is as close as it gets to your net sales. Make sure that you use the net sales value for this calculation by subtracting your return sales data from your gross sales over the given time period.

Stock to sale ratio = Average inventory / Net sales

- Sell through ratio calculated by taking the percentage of units sold of the beginning stock over a given period. This value is also referred to as liquidity ratio, as it tells you the amount of inventory you’ve successfully sold. The closer the ratio gets to 100%, the better it operates. However, this ratio should be monitored closely as the 100% liquidity rate also means that you ran out of items to sell. The ratio is most effectively used to determine your replenishment schedule. The sell-through ratio is generally calculated on a monthly basis.

Sell through ratio = Amount to sold items / Amount of received items

- Week Cover (to sell) or WOC is the average amount of time (in weeks) to sell the stock available. There is also a Daily Cover to sell (DOC) calculation which is the number of days to sells the stock. You can determine which calculation to use by the nature of your business but in order to see a complete view of the effects on the days of the week to your business, many retailers choose to see this value by weeks. If your business is not sensitive to weekday or weekend consumer behavior, you are welcome to use DOC instead.

Week Cover = Amount of inventory on hand / Average amount of products sold weekly

Day Cover = Amount of inventory on hand / Average amount of products sold daily

Related: Excess Inventory: How to Liquidate Old and Surplus Stock in Retail

How is the inventory turnover ratio calculated?

There are two common ways when calculating the inventory turnover ratio. The first one uses your sales data.

The First Formula:

Inventory turnover = Sales / Average inventory

The formula based on sales data can be misleading as the sale value also has a particular profit margin, and you may have promotions during the given time, so it can vary.

It’s commonly advised to use the second method, which uses the cost of goods sold (COGS) data.

The Second Formula:

Inventory turnover = Cost of goods sold / Average inventory

If this data is not available, you should consider using the first formula, keeping in mind the margin used for these products.

As you can realize, both formulas depend on the average inventory. Average inventory is calculated by adding the beginning inventory and the ending inventory within your defined time and dividing it by two.

Let’s dig in and examine some examples of inventory turnover.

Retailer 1

You have a kids & baby store, and you’d like to know how well you sell baby socks. The nature of this product is essential; it’s not seasonal, so you can sell it throughout the year. This ratio can be calculated annually.

Checking your purchasing and sales reports, you indicated a sale of $55.000 worth of baby socks. This is your cost of goods sold to be used in the formula. You have checked your inventory and saw that you had $20.000 worth of socks at the beginning of the year. A year later, this stock was recorded as $5.000.

So your average inventory is:

(Beginning inventory) 20.000 + (Ending inventory) 5.000 = 25.000 / 2 = 12.500

So the inventory turnover ratio is:

55.000/12.500= 4.4

You have turned over your inventory 4.4 times over the last year. Given how frequently babies use socks, this number is quite good for the business -almost one pair of socks for every season.

Retailer 2

You have a household appliances store. You sold $125.000 worth of appliances last year, and your average inventory is $75.000.

The inventory turnover ratio for your products is 1.67, which is lower than Retailer 1; however, due to the nature of your business, the number may be considered an OK indicator.

What is the ideal inventory turnover rate in retail?

If you are working with fast-moving consumer goods, your ideal inventory turnover rate is expected to be more than, say, working in luxury fashion.

You, as a retailer, would not want to create a massive pile of inventory, but on the other hand, you wouldn't want to be left out of stock to sell. You also may have lower inventory turnover for a particular product group, say outerwear, and higher inventory turnover for another group like basic t-shirts.

It needs careful analysis to determine the action plan. So, each retailer should work on finding the optimal ratio for their own nature of business. Just remember the basic rule of modern-day economics, “the opportunity cost,” always works well for retail. The more inventory you hold, the more you reduce the opportunity to sell different products, and your competitors may sell them.

In most cases, a good turnover ratio in retail is between 2 and 4. However, keep in mind that it depends on what you sell, how you sell and to whom you sell. And don’t forget that a good inventory turnover ratio has a few dependents, and generally, the higher the ratio, the better the business is managed.

Which industries have the highest inventory turnover?

It’s valuable to understand that the inventory turnover ratio may vary in relevance to the company’s industry as well. You should always compare your business within your own vertical.

Typically, the industries with higher turnover ratios are retail, clothing, and groceries.

Luxury or niche items such as jewelry, leather, or medical devices have a lower inventory turnover.

What does a good inventory turnover ratio tell us?

If your inventory turnover ratio is high in your industry, you’re probably doing a few things in the right way. It might mean:

- You manage your stock effectively. You know about your purchasing timelines, the order in a timely manner within your forecasts.

- Your sale tactics are working well. You know how to liquidate excess inventory within the given time.

5 ways to manage and improve inventory turnover

If your inventory turnover ratio is low, you need to focus on these five sections within your business.

1. Purchasing

You can revise your orders and purchasing frequency to deliver the optimum inventory on time. You may be ordering too much or too little or having delays in order arrivals.

Efficient restocking is the most effective way to increase turnover. Also, strong negotiation skills are important to get the best pricing from your supplier so the COGS will be lower, which automatically affects the formula in an upward direction.

2. Sales forecasting

You should carefully investigate your year-over-year sales trend and revise your forecasts.

Keep in mind special days for your industry and hold a good ratio before those days arrive. Not every product sells at the same rate as the others, so it’s important to make a trend or group-based analysis when you execute predictive forecasting.

3. Pricing

If your inventory turnover ratio is lower than it's supposed to be, try to use smart pricing techniques.

This way you can determine the prices based on seasonality, week of the day or even hourly pricing changes. You can use special POPs such as product displays to let the customers know that you’ll be having special prices within a limited time.

Related: 12 Successful Retail Pricing Strategies Every Retailer Should Know

4. Promotions & Campaigns

Promotions and campaigns are always the best ways to increase your inventory turnover.

Keep in mind that this will eventually change your sales numbers so if you’re calculating the ratio based on sales, this will affect the ratio more than it does with the COGS formula. You can also try to promote an “outlet” section within your store, and offer bulk buying campaigns.

Related: 8 Sales Promotion Techniques Every Retailer Should Use

5. Point of sales

Think of additional ways to handle inventory and make room for others. You can use the tactics of digital marketing or e-commerce to sell to the customers who are not in your store. Distant shopping will increase the number of your invoices while making room in the store for your local customers to shop effectively.

Increasing your points of sale will automatically increase your customer database without adding additional square meters to your store.